Earn up to 6.50% APY1 + 3 Months with No Requirements to Earn Interest

For a limited time, enjoy 90 days of high-yield interest with no requirements—giving you a head start on earning while you get your account set up.

Offer expires November 30, 2025. During requirement^ waiver period, Annual Percentage Yield (APY) will be determined based on account balance (see balance tiers below). Account has a minimum opening balance of $2,500. After opening, no minimum balance required to earn interest but must maintain a $2,500 average daily balance to avoid $10 monthly service charge. Fees could reduce the earnings on the account.

Your money should work as hard as you do – and now it can!

The tiered levels of this high yield checking account reward you for your everyday banking activities.

First Rate Checking Levels

LEVEL 1

- 4.00% APY on balances up to $30,000 when all requirements^ met

- 0.10% APY on balances over $30,000

- No interest earned when requirements are not met

LEVEL 2

- 4.00% APY on balances up to $30,000 when all requirements^ met

- 6.50% APY on balances $30,000.01 to $60,000*

- 0.10% APY on balances over $60,000

- No interest earned when requirements are not met

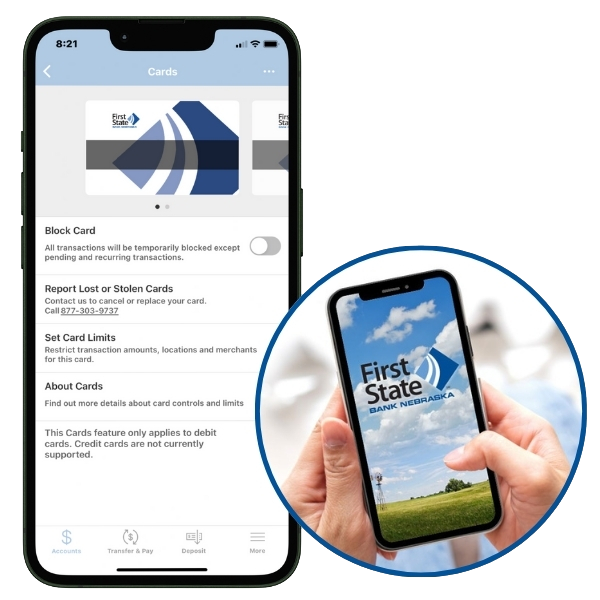

Bank From Anywhere

Accessing your accounts from anywhere should be easy and secure. The First State Bank Nebraska mobile banking app gives you 24/7 account access in the palm of your hand.

Available for Apple and Android devices, the First State Bank Nebraska mobile banking app offers several of the features available in Online Banking. With this Mobile Banking App, you’ll have access to:

- View account balances and transaction history

- Transfer funds between accounts or to regular loan payments

- Pay one-time or recurring bills

- Deposit checks straight to your account without going to the bank

- Find the nearest surcharge-free ATM with MoneyPass® ATM Network

Make the Switch to First State

With our Switch Kit, moving your funds and payments is easy! Our local teams are ready to assist you throughout the entire process. We’re dedicated to making the whole experience as seamless as possible.

GET STARTED

First Rate Checking Levels

LEVEL 1

- 4.00% APY on balances up to $30,000 when all requirements are met1,3

- 0.10% APY on balances over $30,000

- No interest earned when requirements are not met

LEVEL 1 Requirements

- Access internet banking

- Receive e-statements

- At least one online bill payment

- At least one automatic debit or direct deposit

- Minimum of 12 debit card transactions of $5 or more

LEVEL 2

- 4.00% APY on balances up to $30,000 when all requirements are met1,3

- 6.50% APY on balances $30,000.01 to $60,000

- 0.10% APY on balances over $60,000

- No interest earned when requirements are not met

LEVEL 2 Requirements

- Access internet banking

- Receive e-statements

- At least one online bill payment

- At least one automatic debit or direct deposit

- Minimum of 18 debit card transactions of $5 or more

Additional Account Details

Monthly Service Charge:

Maintain a $2,500 average daily balance to avoid $10 monthly service charge

Online Banking:

Included with account

Check Writing:

Unlimited

Optional Overdraft:

Yes

Receive money- and time-saving benefits powered by BaZing

Bill Pay:

Included with account

Mobile Banking:

Yes

Text/Email Alerts:

Yes

Visa Debit Card:

Included with account

Want to learn more or to open an account in-person?

Reach out to our First Rate Checking Expert at 402.858.1737 with any questions or for assistance finding your local branch.

Swipe More. Give More. Get More.

The new levels of our First Rate Checking Account, paired with your school pride debit card, gives more to your schools and puts more money into your account when you swipe more!

Get your schools pride debit card at no extra charge with your First Rate Checking Account. Using your card regularly will help your school raise more money and will help you meet the requirements to earn more interest on your account!

SCHOOL PRIDE DEBIT CARDS

Elevate your earnings and open a First Rate Checking Account today!

1Account has a minimum opening balance of $2,500. Annual Percentage Yield (APY) is accurate as of January 1, 2025. Rates are subject to change at any time. Limit of one First Rate Checking account per customer. ATM surcharges still apply. Message, data, and ISP rates may apply. Fees could reduce the earnings on the account.

2Discount program that includes discounts, money-saving benefits and protection plans. Benefits in the program are subject to change without notice. See separate reference guide for details and specifics on eligibility for each program benefit.

3Must meet all requirements per statement cycle to earn interest.